TOP-Beiträge

New Wexo Cashback App: More than cashback

Wexo launches a new generation of its Cashback app – a modern platform where you earn real value in Bitcoin, gold,...

Mehr lesen

Wexo 4.0 Is Coming: What to Expect from the Scheduled Maintenan...

We’re getting ready to launch Wexo 4.0 with a major infrastructure upgrade. Learn what’s changing, why a new passwo...

Mehr lesen

Deflation in Action: 3,541,053 WEXO Tokens Burned

The fifth burn round has permanently removed over 3.5 million WEXO tokens from circulation. Learn what this means f...

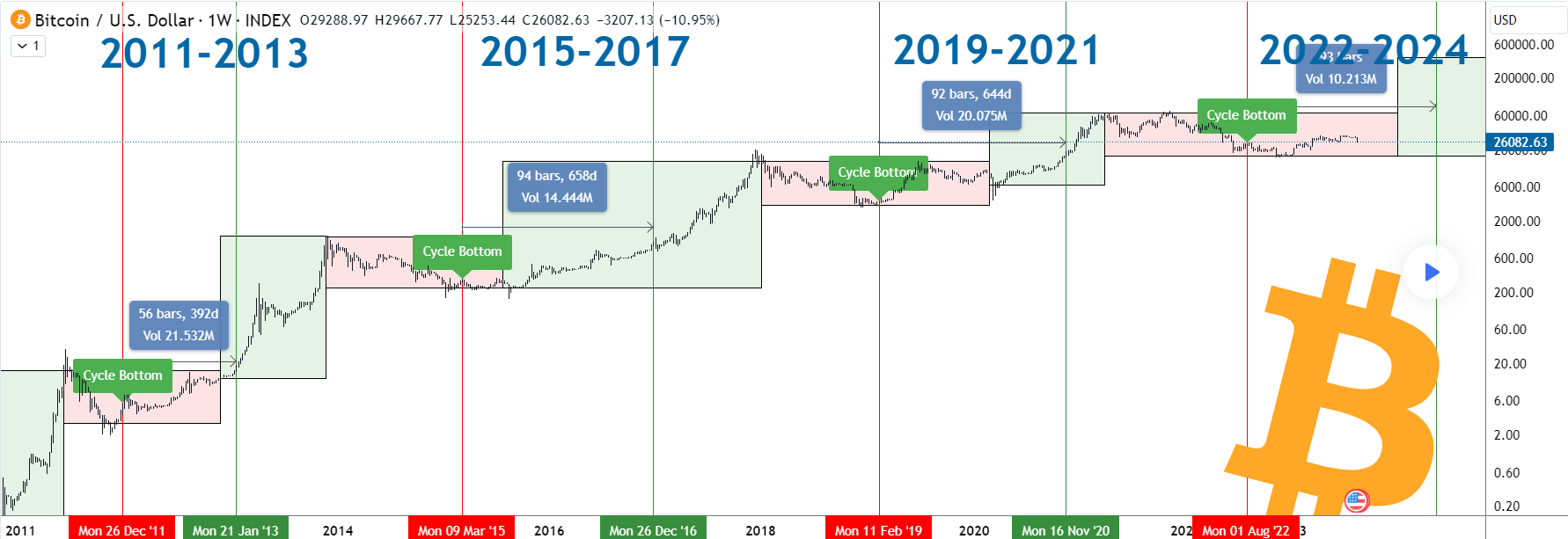

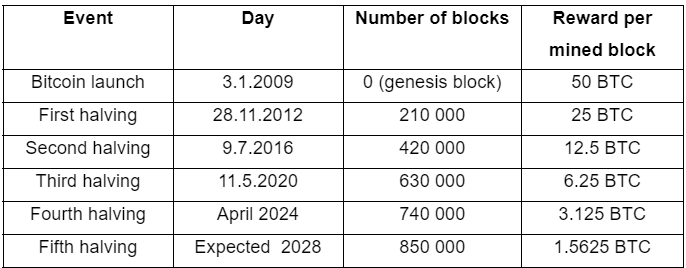

Mehr lesenThe reward for mining Bitcoin will be cut in half when the number of blocks reaches 740,000. This is expected to occur in April 2024, at which time the reward per block will decrease from 6.25 BTC to 3.125 BTC. Historically, this event has been associated with an increase in the value of Bitcoin (BTC), hence it attracts the attention of investors.

Typically, the price of Bitcoin increases about six months before the halving and remains relatively stable during the event itself. The primary increase occurs in the year following the halving.

However, it is important to note that past performance is not indicative of future results. It remains to be seen whether Bitcoin will maintain its current trend. This event is not the only factor that determines the movement of Bitcoin's price. Market sentiment, adoption, regulatory developments, macroeconomic factors, and technological progress also play a crucial role in influencing the value of the cryptocurrency.

Why does Bitcoin's value get cut in half, and what are the economic implications?

The halving of Bitcoin mining rewards is a key part of Bitcoin's monetary policy. It is built into the blockchain, created by an individual or group under the pseudonym "Satoshi Nakamoto," and thus cannot be influenced externally.

The software that miners run requires computers in the network to compete in verifying transactions through a process known as "mining." The software rewards them with a certain amount of new bitcoins when they prove selected transactions are valid.

Transactions are verified in groups called "blocks," and the blockchain is coded to cut the reward miners receive in half every 210,000 blocks.

The goal is to control its supply and thus create scarcity.

What happens to miners when the Bitcoin reward Is halved?

When the block reward is halved, some miners may find that mining is no longer profitable due to costs such as electricity and hardware. Some may stop mining altogether if the price of Bitcoin does not increase to offset this, thereby reducing the amount of computational power in the network. Regardless, the speed of block mining should not be affected, as the software automatically adjusts the difficulty of verifying transactions to maintain a stable rate.

What happens when all 21 million Bitcoins are mined?

After the maximum supply of 21 million bitcoins has been mined, miners will no longer receive new bitcoins for verifying blocks. However, they will continue to receive transaction fees - contributed by those making payments - as an incentive to verify transactions. It is estimated that the last new bitcoin will be mined in 2140. At this point, the cryptocurrency will become deflationary, as coins can be "lost" due to user error, for example, by sending coins to an invalid address.

What will the price of Bitcoin (BTC) be after the halving?

Many have speculated that the price of Bitcoin will increase in the weeks before and after the event. This is partly because the halving is expected to draw increased attention to Bitcoin, but also because it will reduce the supply of new coins entering circulation.

Any potential price increase, however, will depend on how demand for bitcoins develops. There is no guarantee that the price will rise - or even remain stable - as the price of Bitcoin is volatile, and significant drops in price have been seen in the past.

Author: Marek Kalina

Founder of the financial portal www.finfin.sk