Bitcoin is more ECO than banks or the gold mining industry

ALTCOIN BITCOIN (BTC) MINING PoW (Proof-of-Work)04-Feb-2022

TOP-Beiträge

New Wexo Cashback App: More than cashback

Wexo launches a new generation of its Cashback app – a modern platform where you earn real value in Bitcoin, gold,...

Mehr lesen

Wexo 4.0 Is Coming: What to Expect from the Scheduled Maintenan...

We’re getting ready to launch Wexo 4.0 with a major infrastructure upgrade. Learn what’s changing, why a new passwo...

Mehr lesen

Deflation in Action: 3,541,053 WEXO Tokens Burned

The fifth burn round has permanently removed over 3.5 million WEXO tokens from circulation. Learn what this means f...

Mehr lesenBitcoin is blamed for energy consumption. But what would be the result if we compare it with the banking system or gold mining?

Why does Bitcoin consume more energy than some countries do?

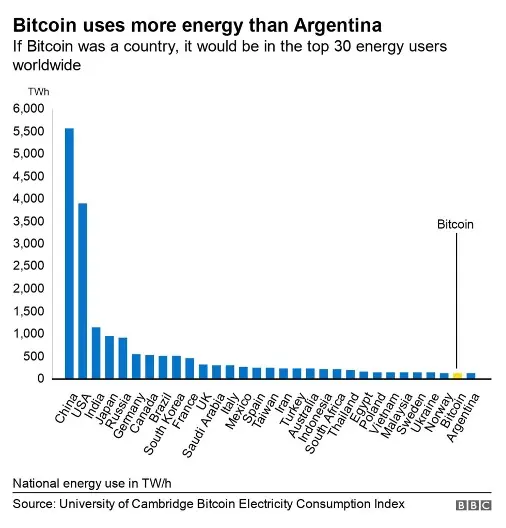

According to an analysis from Cambridge University, Bitcoin consumes more electricity annually than all of Argentina, the Netherlands, the United Arab Emirates, and many other smaller countries. According to scientists, Bitcoin consumes about 121.36 terawatt-hours (TWh) per year - and this energy consumption is unlikely to decrease.

The reason is in Bitcoin´s structure. The operation of the Bitcoin blockchain network works based on a proof-of-work consensus. Computational power is required for the miner´s work to create a new block. Over the years, the Bitcoin blockchain network has grown, and the complexity of doing this has increased, so does the necessary computing power of miners.

Whereas it was possible to mine Bitcoin on a regular personal computer in the past, today, an entire room of specialized equipment is required for the same work. Of course, a lot of electricity is needed to run it.

Bitcoin's electricity consumption exceeds Argentina (121 TWh), the Netherlands (108.8 TWh) and the United Arab Emirates (113.20 TWh) - and is gradually approaching Norway (122.20 TWh). Bitcoin doesn't look good at all in this comparison. On the other hand, the amount of electricity consumed each year by always-on inactive home devices, only in the USA could power the entire Bitcoin network for one year.

Bitcoin is greener and more ECO than the banking system and the gold mining industry

Cryptocurrency Bitcoin is known as the "digital gold" for its features; many predict that Bitcoins will replace the conventional banking systems.

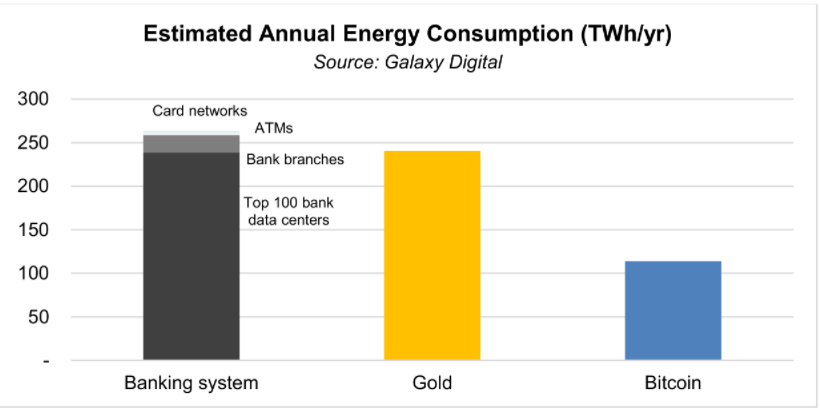

Compared to these sectors, the Bitcoin network represents just a half of the energy intensity. We also should not forget the gold mining's environmental impacts.

The banking system operation, including data centres, all ATMs and card networks, consumes 263.72 TWh of energy per year. Of course, the operation of buildings and various other premises used by banks are not included. However, even without this data, Bitcoin requires more than twice the energy for its smooth running and blockchain.

Some interesting facts:

-

The global annual energy supply is 1,458.2 times greater than the Bitcoin network needs.

-

The amount of electricity lost during transmission and distribution each year is 19.4 times higher than the Bitcoin network consumption.

-

The energy footprint of "always-on" electrical appliances in households is 12.1 times greater than the Bitcoin network consumption.

SOURCE: Galaxy Digital

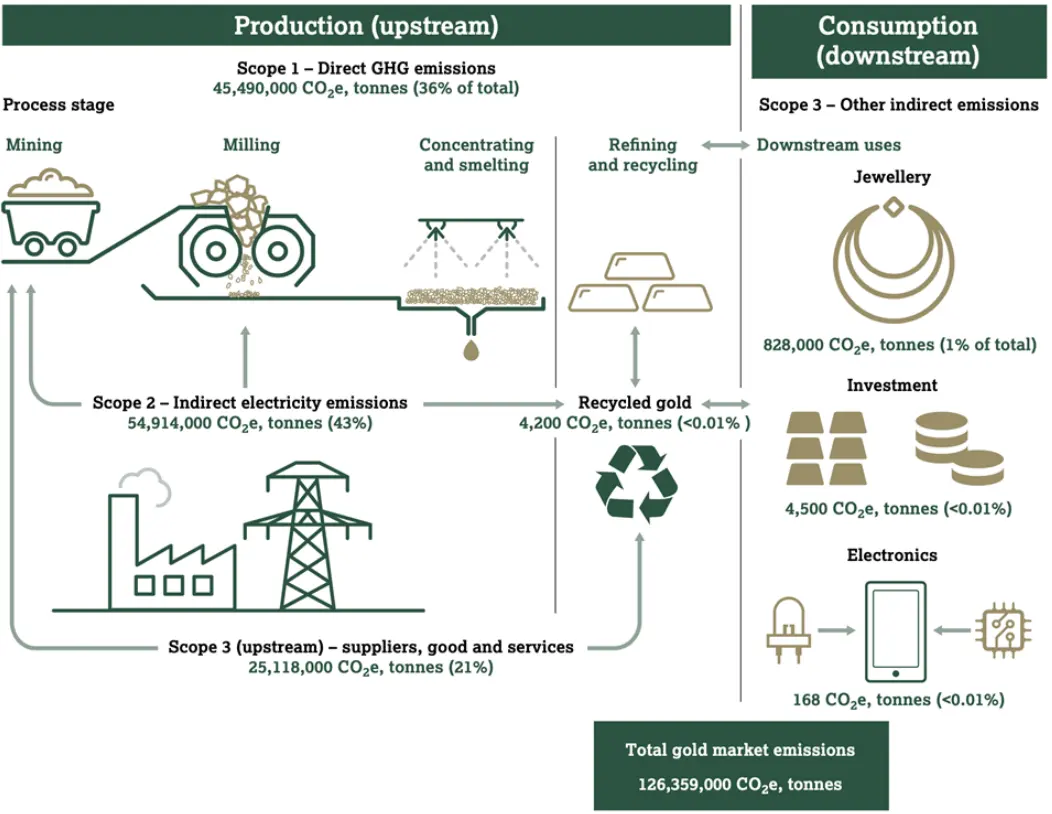

The gold industry (from production to processing) produces more than 126 mil tons of CO2, representing 240.61 TWh. However, it is not possible to include emissions and second-order energy consumption related to gold transportation, etc. Even this consumption is more than double of Bitcoin needs.

SOURCE: Galaxy Digital

Renewables power Bitcoin at 40% to 75%

What if we could mine Bitcoins using multiple renewable energy sources, such as wind, solar or water?

It is difficult to precisely determine how many Bitcoin miners use renewable resources for their operation due to the very nature of Bitcoin - a decentralized currency whose miners are mainly anonymous.

Bitcoin's renewables' use estimates range from 40 % to almost 75 %.

With increasing regard for ecology, Bitcoin mining also offers a solution. Companies such as Great American Mining, Upstream Data and Crusoe Energy Systems build a wellhole methane capture infrastructure and use otherwise wasted gas to extract Bitcoins. In this way, oil producers can secure a 24-fold reduction in emissions compared to methane emissions.

There is no denying that the Bitcoin network consumes a considerable amount of energy, but this energy consumption makes it so robust and secure. It is adequate to talk about high energy intensity, especially if Bitcoin consumes half of the energy that the banking sector or the gold industry do?